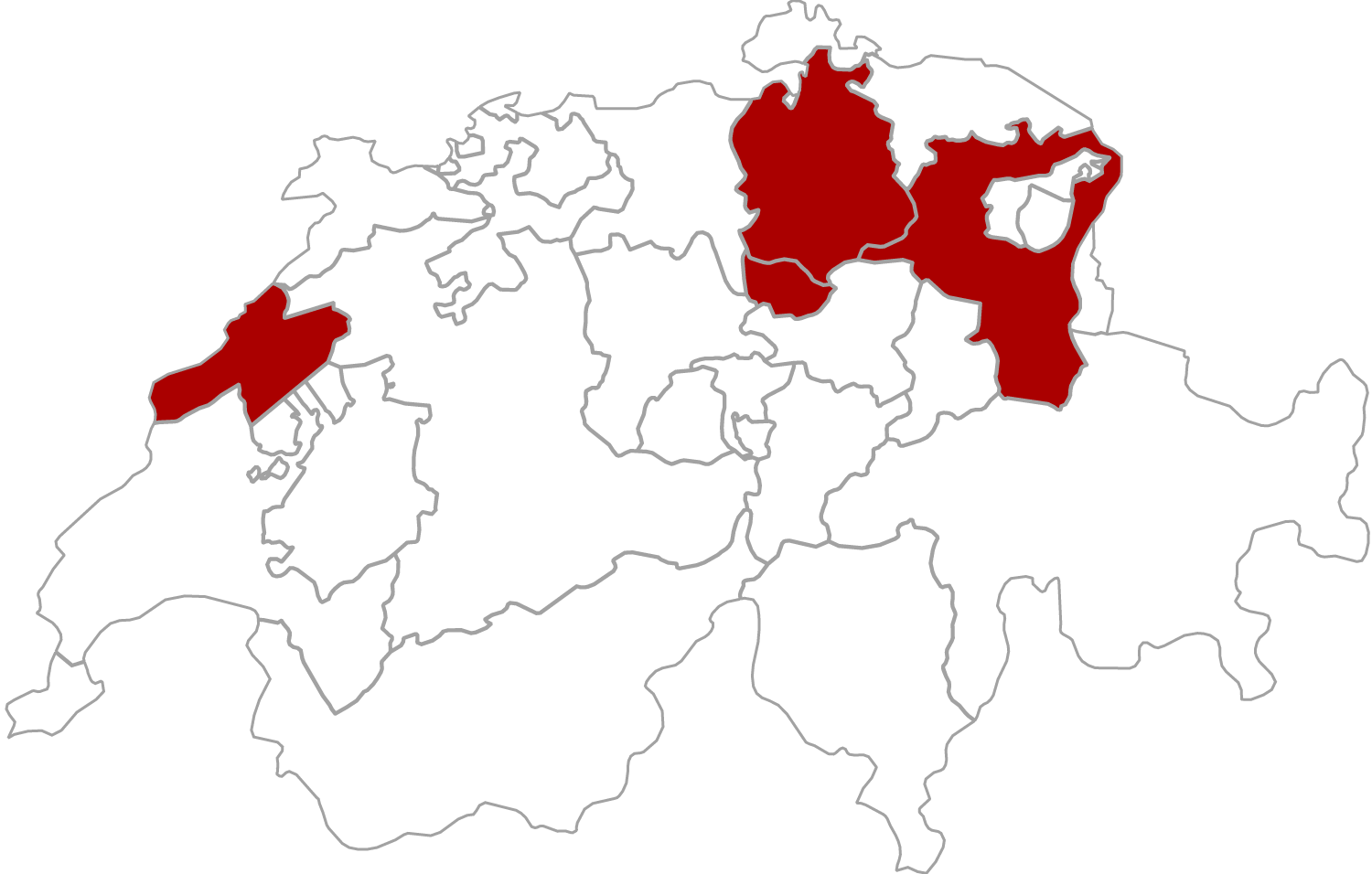

Locations

Nothing is glossed over in our advice. If you decide to set up or acquire a company in Switzerland, you should have a basic knowledge of Swiss taxes and other duties. Here are some of the advantages and disadvantages of the Swiss tax system, with a special focus on foreign investors. After weighing up the pros and cons, the Swiss tax system is attractive and also highly socially fair.

Advantages

- The authorities have great trust in Swiss taxpayers. The self-responsibility of citizens and corporate bodies is held in high regard. This is why tax audits and reviews are kept to a minimum. The tax commissioners are very well trained, which favours a fair tax assessment. The deadlines for various levies are reasonable and can be extended well beyond the regular levy date.There are generous payment deadlines for settling tax debts, which in turn can be extended with correspondingly credible justification.

- Since the vote on the VAT III tax reform, which was approved by a large majority of Swiss voters, Switzerland has had very attractive corporate taxes. Swiss VAT with the standard rate of 7.7% is very low compared to other countries and the EU, with rates of over 20% in some cases. For this reason, a number of companies have already set up in Switzerland that mainly export overseas.In complicated situations, taxable persons and companies can agree tax rulings with the tax authorities. This leads to legal certainty with an otherwise uncertain outcome. Few countries offer this option.Switzerland is still wrongly regarded abroad as a tax haven. However, tax burdens (including social security contributions) of around 50% can arise in the middle and higher income bracket. This must be avoided through skilful tax planning. For foreign investors in particular, the tax burden can be reduced to the bare minimum.

Disadvantages

- Swiss taxpayers are regularly scrutinised when their assets are determined. The system, which is probably unique in the world, leaves little room for illicit money and money laundering. There is a simple control calculation for this:

Taxable assets from the previous year

+ Taxable income

- General living expenses

= New wealth level

If significantly more wealth is declared than this control calculation logically results in, the tax inspector will ask where the additional wealth comes from. The wealth tax is progressive and goes up to one per cent (simple tax). As an investor resident abroad, this tax is not relevant. The pension-forming AHV income (1st pillar social insurance - see more on the topic of Swiss social insurance) is CHF 84,600. The AHV contributions on a higher salary no longer benefit the person paying in. It benefits the general public (AHV fund) and is therefore purely a tax. However, the situation is worse with unemployment contributions for corporate bodies. They pay 2.2% of their gross salary and are not entitled to draw unemployment benefits in the event of unemployment.Solution for foreign investors: draw salary abroad (at place of residence) and/or withdraw profits via dividend distributions.Switzerland does not have a group tax law like other countries. This means that profits of individual companies cannot be offset against losses of other companies belonging to the group. Each company is taxed separately. Nevertheless, losses can be offset against future profits within seven years.Switzerland has an extremely high withholding tax of 35% on profit distributions (dividend payments). Depending on the place of residence abroad and which double taxation agreement has been concluded with Switzerland, if any, a large part of this "security tax" can be reclaimed.